Introduction

As a small business owner in Michigan, you face a unique set of challenges and risks. From unexpected accidents to natural disasters, the potential threats to your business can be overwhelming. That’s where small business insurance comes into play – a vital component of safeguarding your livelihood and ensuring the long-term success of your enterprise.

In this comprehensive guide, we’ll explore the intricacies of small business insurance in Michigan, delving into the various coverage options, regulatory requirements, and strategies for selecting the right policies to protect your business.

Understanding Small Business Insurance in Michigan

Small business insurance in Michigan is a complex and multifaceted topic, with a wide range of policies and coverage options available to cater to the unique needs of different industries and business models.

Types of Small Business Insurance Coverage

The most common types of small business insurance coverage in Michigan include:

- General Liability Insurance: Protects your business from claims of bodily injury, property damage, and personal/advertising injury.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this coverage protects your business from claims of professional negligence or mistakes.

- Commercial Property Insurance: Covers the physical assets of your business, such as your building, equipment, and inventory, in the event of damage or theft.

- Workers’ Compensation Insurance: Mandatory in Michigan, this coverage provides medical benefits and wage replacement for employees who are injured or become ill on the job.

- Commercial Auto Insurance: Covers your business-owned vehicles and protects your company from liability in the event of an accident.

- Business Interruption Insurance: Provides financial protection if your business is forced to temporarily cease operations due to a covered event, such as a natural disaster or equipment breakdown.

- Cyber Liability Insurance: Protects your business from the financial and legal consequences of data breaches, cyber attacks, and other digital threats.

Regulatory Requirements in Michigan

In Michigan, certain small business insurance coverage is required by law. For example, all employers in the state are required to carry workers’ compensation insurance, regardless of the number of employees. Additionally, businesses with vehicles used for commercial purposes must maintain commercial auto insurance.

Understanding these regulatory requirements is crucial to ensure your small business is in compliance and protected from potential legal and financial consequences.

Factors to Consider When Choosing Small Business Insurance

Selecting the right small business insurance policies in Michigan can be a complex and daunting task. However, by considering the following factors, you can make an informed decision that best aligns with your business needs and risk profile.

Industry and Business Type

The specific insurance needs of a small business can vary significantly depending on the industry and nature of the business operations. For example, a construction company may require more comprehensive coverage related to general liability and workers’ compensation, while a professional services firm may prioritize professional liability insurance.

Business Size and Employees

The number of employees, annual revenue, and overall scale of your small business can also influence the types and levels of insurance coverage required. Larger businesses may need more comprehensive policies to protect their assets and operations.

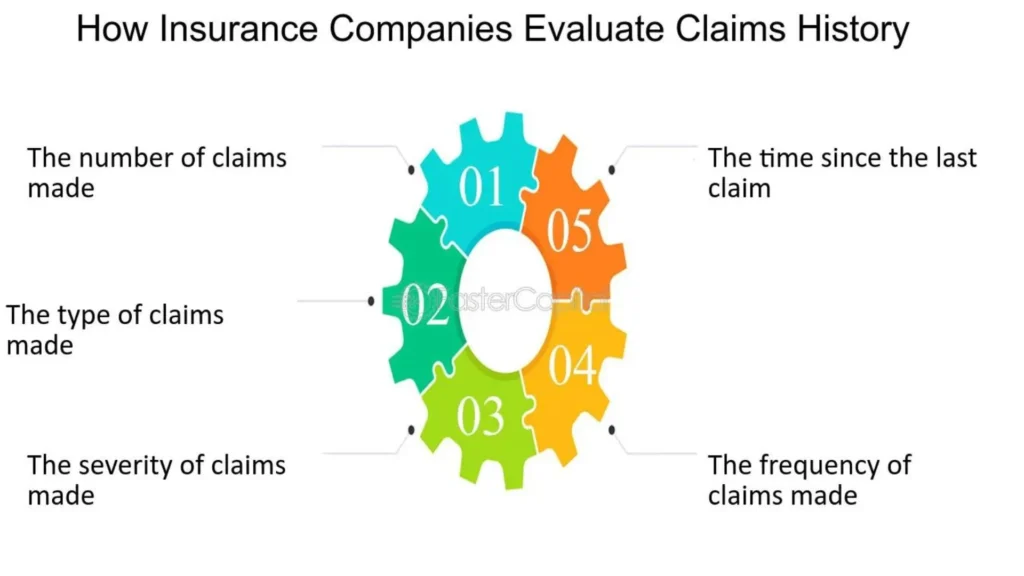

Risk Exposure and Claims History

Evaluating your business’s risk exposure and past claims history can help you identify the most critical areas that require insurance protection. This information can guide you in selecting the appropriate coverage limits and deductibles.

Budget and Cost Considerations

Small business owners must balance the need for comprehensive insurance coverage with the realities of their budget. Researching and comparing quotes from multiple insurance providers can help you find the most cost-effective solutions without compromising on critical protection.

Customization and Flexibility

Many insurance providers offer the ability to customize policies or bundle coverage options to better suit the unique needs of your small business. Look for insurers that can provide flexible and tailored solutions.

Navigating the Small Business Insurance Marketplace in Michigan

The small business insurance landscape in Michigan can be complex, with numerous providers, policies, and coverage options available. Navigating this marketplace effectively can be a daunting task, but with the right strategies and resources, you can find the coverage that best protects your business.

Identifying Reputable Insurance Providers

When selecting an insurance provider for your small business in Michigan, it’s essential to research the company’s financial stability, customer service reputation, and claims-handling abilities. Look for insurers with a strong presence in the state and a track record of supporting small businesses.

Comparing Quotes and Coverage Options

Obtaining multiple quotes from different insurance providers is crucial to finding the most comprehensive and cost-effective coverage for your small business. Be sure to compare not only the premiums but also the policy details, exclusions, and deductibles.

Working with an Insurance Agent or Broker

Collaborating with an experienced insurance agent or broker who specializes in small business coverage can be invaluable. These professionals can provide guidance, expertise, and access to a broader range of insurance products and carriers.

Ongoing Review and Adjustment

As your small business evolves, your insurance needs may change. Regularly reviewing your coverage, updating policies, and making necessary adjustments can help ensure your business remains adequately protected.

The Importance of Small Business Insurance in Michigan

Small business insurance in Michigan is not just a luxury – it’s a vital component of your business strategy and long-term sustainability. By investing in the right coverage, you can safeguard your assets, protect your employees, and mitigate the financial impact of unexpected events.

Risk Mitigation and Business Continuity

Small business insurance helps you manage and transfer risks, ensuring that your operations can continue uninterrupted in the face of adverse circumstances. This can be particularly crucial in a state like Michigan, where natural disasters, such as severe storms and flooding, pose real threats to small businesses.

Financial Protection and Liability Coverage

In the event of a claim or lawsuit, small business insurance can shield your company from financial liabilities, legal expenses, and potential damages. This protection can be the difference between weathering a crisis and facing insurmountable financial challenges.

Compliance and Regulatory Adherence

Maintaining the appropriate small business insurance coverage, as required by Michigan law, can help you avoid penalties, fines, and potential legal issues. This compliance demonstrates your commitment to responsible business practices and can instill confidence in your customers, partners, and employees.

Competitive Advantage and Credibility

Carrying comprehensive small business insurance can enhance your credibility and competitiveness in the Michigan market. Clients and partners may be more inclined to work with companies that demonstrate a commitment to risk management and financial stability.

Conclusion

Navigating the complexities of small business insurance in Michigan is a crucial task for any entrepreneur seeking to safeguard their livelihood and ensure the long-term success of their enterprise. By understanding the available coverage options, regulatory requirements, and strategies for selecting the right policies, small business owners can proactively mitigate risks, protect their assets, and focus on growing their business with confidence.

As the small business landscape in Michigan continues to evolve, the importance of small business insurance will only become more pronounced. By embracing a comprehensive approach to risk management and staying attuned to the changing needs of their operations, small business owners can position their companies for long-term resilience and prosperity.